9.3

8.064 reviews

English

EN

The first quarter of this year saw a notable surge in demand for gold, which reached its highest level in eight years, according to the World Gold Council. This increase was primarily driven by robust investment from both the over-the-counter (OTC) market and central bank purchases.

Central banks played a crucial role in driving the surge in gold demand during the first quarter. Central bank purchases totalled 290 tonnes, according to the World Gold Council's report, marking the strongest start to a year since 2000. In particular, the People's Bank of China reported a significant addition of 27 tonnes to its gold reserves during this period, continuing its series of monthly increases. The consistent increase in central bank purchases, which in recent years have exceeded 1,000 tonnes per year, underlines the continued importance of central bank purchases. gold as a strategic asset for reserve portfolios.

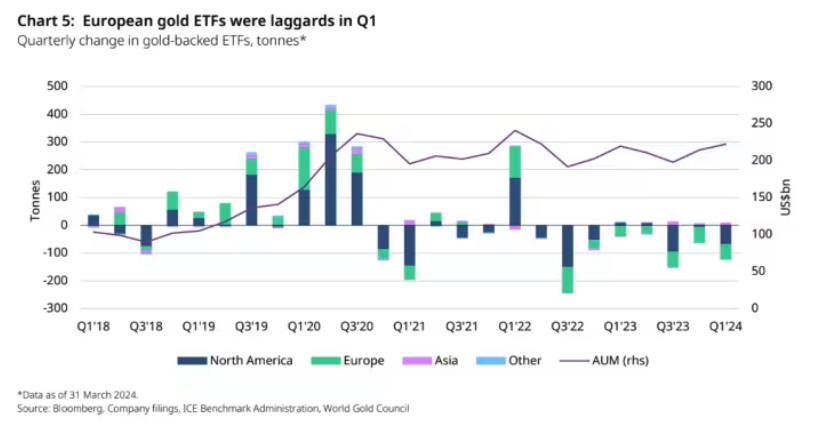

The investment sector, including both OTC Transactions as exchange-traded funds (ETFs), contributed significantly to the rise in demand for gold. OTC purchases rose to 136.4 tonnes, more than three times the amount recorded the previous year. Despite a notable decline in ETF holdings, global investment in ETF holdings Gold bars and Gold Coins see an increase of 3% year-on-year to 312 tonnes. Heightened geopolitical risks, ongoing macroeconomic uncertainties and increased net buying in the derivatives market were cited as key drivers of strong demand in the investment sector.

Although global gold ETFs outflowed by 114 tonnes in the first quarter, regional trends in ETF flows varied significantly. Europe and North America experienced outflows from gold ETFs, largely influenced by investors looking for alternative investment opportunities amid uncertain economic conditions and an unclear monetary policy outlook. In contrast, Asia emerged as a surprise market for ETF growth, with investors in India and China showed a concerted effort to include gold in their investment portfolios. This shift reflects a remarkable transition from Western to Eastern investors influencing the dynamics of the gold market.

Despite fluctuations in ETF flows and market uncertainties, analysts remain optimistic about the future prospects for gold investments. Factors such as expected interest rate cuts, Geopolitical tensions and the weakening strength of the dollar are expected to continue to support demand for gold as a safe haven. The World Gold Council's report highlights the potential for further growth in the gold ETF space, especially with the prospect of long-awaited rate cuts and ongoing geopolitical factors shaping global investment trends.

The robust demand for gold observed in the first quarter of this year underscores its continued importance as a strategic asset for investors and central banks alike, with promising prospects for further growth in the coming quarters.

On Thursday 16 May 2024, Holland Gold will host a event on Gold and world politics in the Georg Kessler Lounge at the AFAS AZ Stadium.

The event consists of three parts: one interview, one presentation and a Q&A session for the audience. For example, the gold rush is discussed in World Politics, the geopolitical tensions that are rising every day; in Ukraine, the Middle East, in West Africa and around Taiwan. What impact does this have on the financial system? Central banks seem to be caught in a gold rush. The yellow metal achieves a Record price. How long will the US dollar remain dominant?

Buy your tickets here: https://www.hollandgold.nl/evenement/

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink and Joris Beemsterboer interview various economists and experts in the field of macroeconomics. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.