9.3

8.064 reviews

English

EN

China has at least $106 billion in foreign exchange reserves in the past two weeks Sold, including long-term U.S. Treasuries. China is selling U.S. debt to stabilize the value of the currency, following the devaluation two weeks ago.

China has at least $106 billion in foreign exchange reserves in the past two weeks Sold, including long-term U.S. Treasuries. China is selling U.S. debt to stabilize the value of the currency, following the devaluation two weeks ago.

Over the past 12 months, China has already disposed of $315 billion in foreign exchange reserves. Bloomberg estimates that China's foreign exchange reserves, totaling $3.65 trillion, will fall by another $40 billion this year.

"Through the sale of U.S. Treasuries, China is preventing U.S. debt yields from falling, despite the large fall in stock prices. So China has a direct impact on global financial markets through U.S. interest rates," so concludes Bank of America's Dadid Woo.

Normally, you would expect US Treasury yields to fall, as a correction in the stock market is normally accompanied by a flight to US Treasuries. As a result, interest rates should normally fall, but because foreign countries are selling these government bonds at the same time, we see the opposite happening.

China has an estimated $1.48 trillion in U.S. Treasuries, of which $200 billion is held in Belgium, according to Nomura Holdings. With these dollar reserves, China can bring the exchange rate of the yuan to the desired level without any problems.

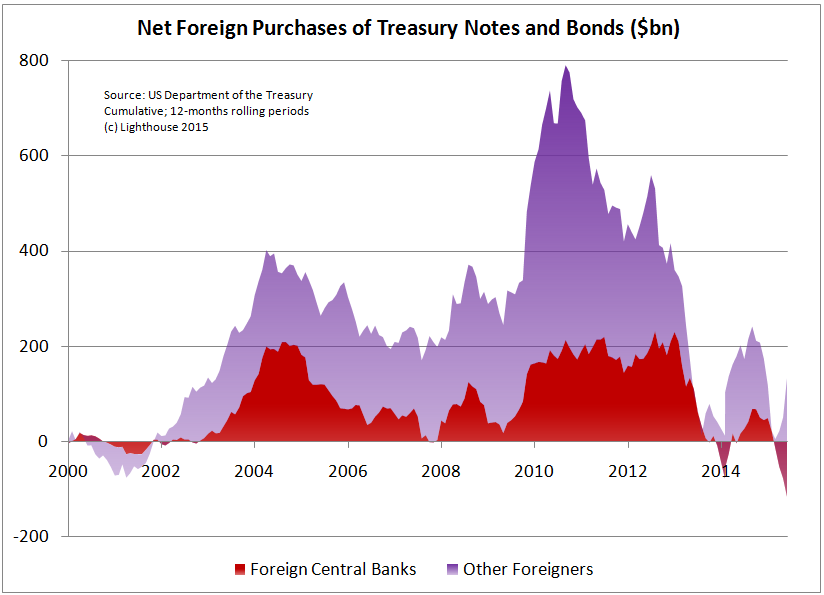

Central banks sell U.S. Treasuries (Source: Lighthouse Asset Management)

It's not just China that is selling US Treasuries. Other central banks are also increasingly interested in US debt. The following charts from asset manager Lighthouse show at a glance that foreign support to finance US budget deficits is drying up. Central banks are almost non-existent, a very significant development.

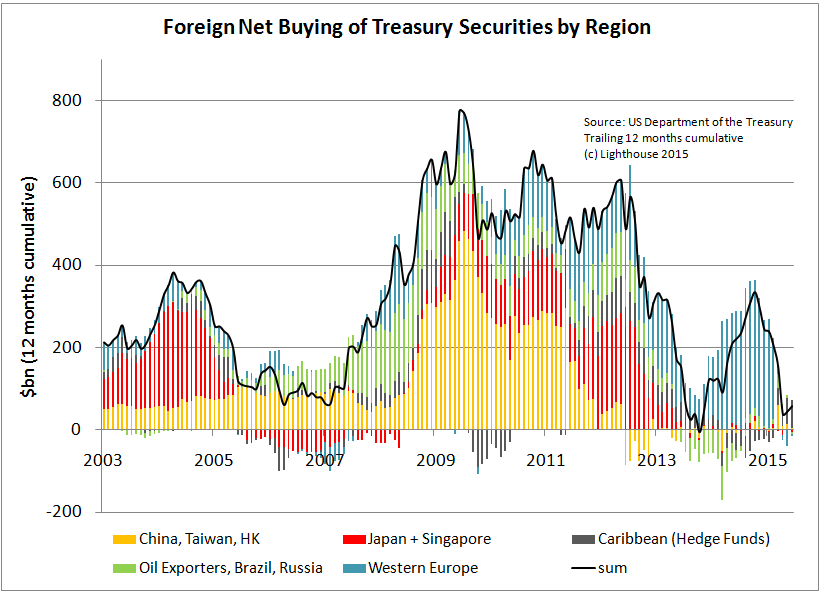

Of course, the fall in oil prices plays an important role in this, but the slowdown in growth in China is also an important factor. If Chinese exports fall, that means a smaller trade surplus and therefore fewer dollars to invest in US debt.

The Chinese and Russians are shifting their preference from dollar reserves to physical gold. Both countries have added hundreds of tons of gold to their reserves in recent years, while reducing their exposure to dollars. The fact that these emerging economies support gold indicates that the metal still plays an important role in the monetary system.

Which country still buys U.S. Treasuries? (Source: Lighthouse Asset Management)