9.3

8.064 reviews

English

EN

China's central bank has added 16 tonnes of gold to its reserves in the past month, according to the latest figures from China's State Administration of Foreign Exchange (SAFE)). The total gold stock at the end of August amounted to more than 1,693 tonnes, which represents a value of almost $61.8 billion when converted to the gold price at the end of August. In July, China's central bank added more than 19 tons of gold to its reserves.

China Gives Transparency to Gold Stocks

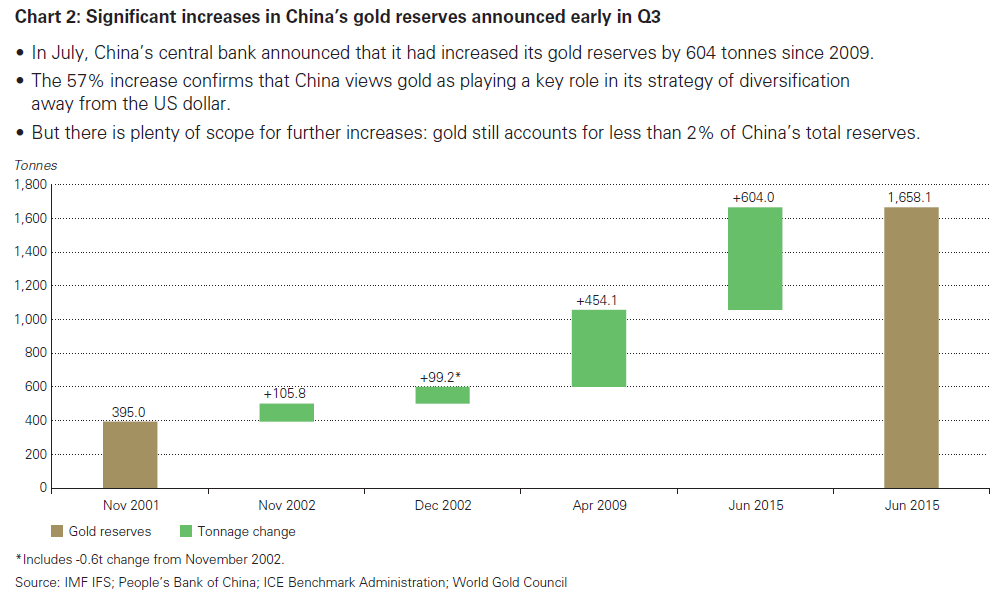

China's central bank suddenly announced the size of its gold holdings in June, after being very secretive about it for five years. From April 2009 to June 2015, the Chinese bought a total of 604 tonnes of gold, equivalent to almost a hundred tonnes per year. Since then, the central bank has provided a status update every month, adding 19 tonnes of gold in July and adding another 16 tonnes of the yellow metal to its reserves in August.

China has bought a lot of gold in recent years (Source: World Gold Council)

China values gold by market value

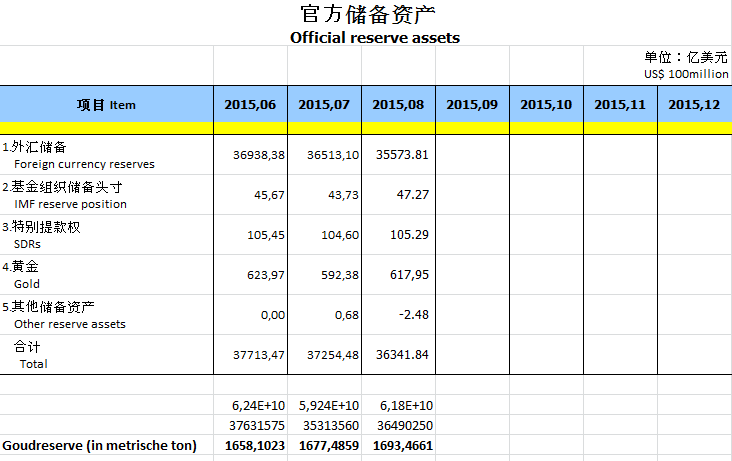

With the publication of the gold stocks, China has also applied a different valuation method. Starting in June, China values its gold reserves on a monthly basis according to the current gold price. Research by FOFOA tells us that the Chinese central bank has the last London fixing of the month.

We know that China values gold stocks at market price, because the value of gold fell in July, while the volume had increased by 19 tons. In June, the gold reserve was worth $62.4 billion, but a month later it had dropped to $59.24 billion due to the fall in the gold price.

The following overview from the Chinese central bank shows that the value of the gold reserve increased again in August, partly due to the increase in the price of gold and partly due to the addition of 16 tonnes of gold to the reserves. We have calculated these figures for you, see the table below.

China's gold reserves grew to more than 1,693 tonnes (Source: SAFE)

China continues to buy gold

Now that China is open about its gold reserves, we no longer need to speculate about it. The country has been buying gold almost continuously in recent years and is likely to continue to do so for some time to come. In relation to the total foreign exchange reserves and in relation to the size of the economy, the country still has relatively little gold. If there is a reset of the international monetary system, China wants to have a stronger position in it. And that means that the country will be even more will buy gold.

China adds 16 tonnes of gold to reserves