9.3

8.064 reviews

English

EN

The central bank of Russia added 30 tonnes of gold to its reserves in March added, the largest monthly purchase since September last year. In the first two months of this year, the central bank decided to wait a little longer with Buy gold, but with the addition of 30 tons of gold, it has become clear that Russia still wants more gold.

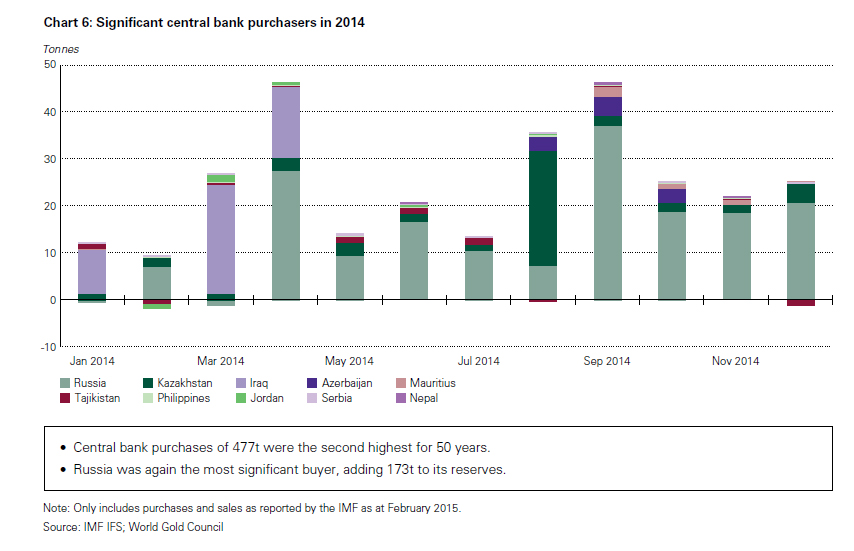

In the last nine months of last year, the country continuously added precious metal to its reserves. Figures from the World Gold Council confirmed that Russia bought the most gold by far of all countries last year.

As a result of this purchase, Russia's total gold reserves grew to 1,238 metric tons, placing the country in fifth place among countries with the largest gold reserves. The Bank of Russia continues to buy gold to diversify foreign exchange reserves and strengthen the ruble, central bank governor Elvira Nabiullina said.

The fact that Russia continues to buy precious metals despite the crisis and the depreciation of the ruble is a very positive signal for the gold market, David Jollie, an analyst at Mitsui & Co. Precious Metals, told Bloomberg. Measured in rubles, the gold price was at a gain of more than 20% earlier this year, but due to the recovery of the Russian currency, the price of a troy ounce of gold in Russia has returned to the level of the beginning of this year.

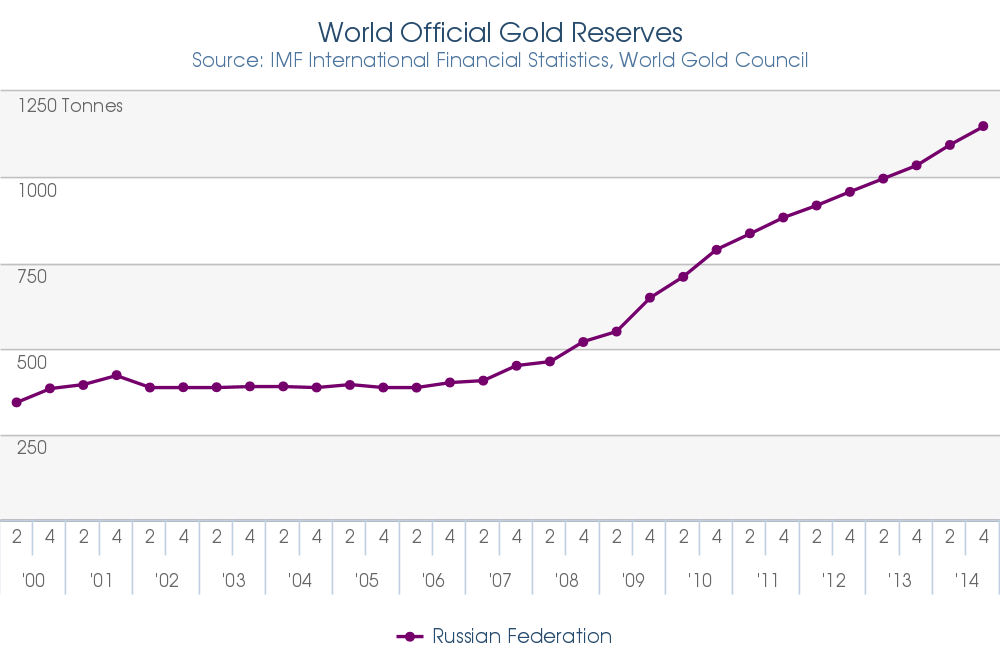

Russia has been buying gold for years

In 2005, the central bank of Russia decided to completely change its monetary policy. After years of Selling gold the central bank returned to the market as a buyer of gold. In the space of barely a decade, the country has managed to expand its gold reserve from less than 300 to more than 1,200 tons, a fourfold increase. The position in gold on the balance sheet total has increased even more sharply, as the central bank has been valuing its precious metal according to the market price since 2006. Previously, a (much lower) historical Gold price Worked.

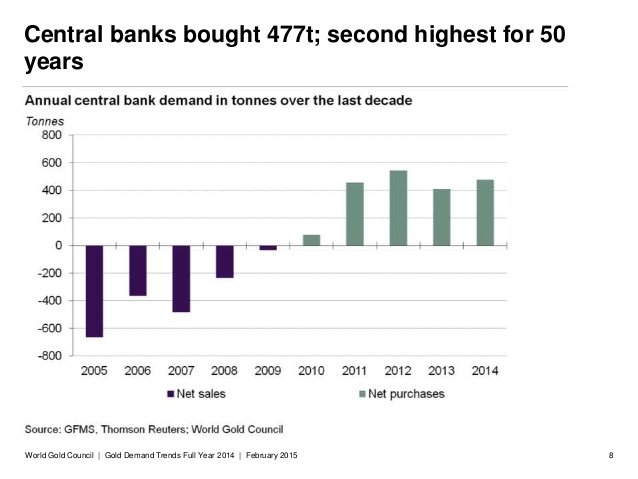

As a result of this new purchase, the share of gold in the total reserves of Russia will rise to 13 percent of the total. According to the World Gold Council, central banks worldwide will add at least 400 net tonnes of gold to their reserves this year, equivalent to about 10% of the precious metal's annual supply.

Russia was the largest buyer of gold in 2014

Central banks continue to buy gold