9.4

7.693 Reviews

English

EN

According to Warren Hogan, chief economist of the Australia & New Zealand Bank, the Gold price between now and 2030 double to $2,400 per troy ounce. A growing middle class in Asia will allow more people to buy gold, which will boost demand for jewellery and investment gold. In addition, Hogan foresees an increasing interest in investing in gold among asset managers, institutional investors and central banks in the Asian region.

Together, these factors support Hogan's view that the price of gold will rise over the long term, reaching a level of around $2,400 per troy ounce by 2030. In his latest report 'East to El Dorado: Asia and the future of gold', he describes that the increasing purchasing power in Asian countries will further fuel the private demand for gold. Some of that demand will find its way into gold derivatives and gold-related stocks, but due to the strong cultural connection people have with gold in this region, there will also be a lot of demand for the physical metal.

The demand for gold in China, India, Indonesia, Japan, South Korea, Malaysia, the Philippines, Singapore, Thailand and Vietnam is currently around 2,500 tonnes, a volume that could double to 5,000 tonnes per year in fifteen years, according to ANZ Bank's chief economist.

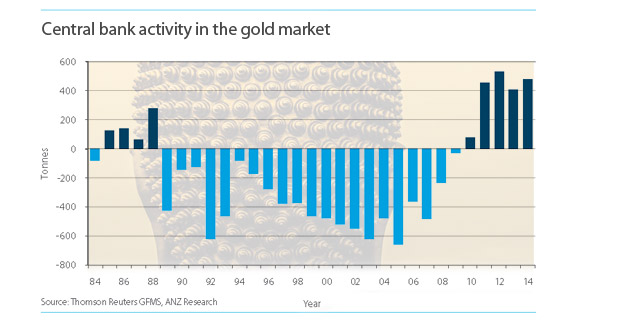

Central banks will also buy more gold, according to Hogan, as a kind of safety buffer for a new era with fairly floating exchange rates. ANZ's chief economist calculated that Asian central banks still need about 8,000 tonnes of gold to boost their gold reserves to an average of 5% of total reserves. That's equivalent to almost three years of mine production.

Emerging market central banks began in 2009 to Buy gold and are expected to continue to do so in the coming years. Emerging markets in particular are buyers of gold, because these economies have few gold reserves compared to the West.

According to Hogan, China will gain more and more influence in the global gold market. The country has been the largest producer of gold for a number of years and was also the largest importer of the yellow metal in 2013. The demand for gold in China has also exploded in recent years. The chief economist of ANZ Bank therefore also sees an important role for the Shanghai Gold Exchange and the Shanghai Futures Exchange. Shanghai will become a major hub for physical gold trading in the future, just as London and New York are today.

In the short term, ANZ Bank does not expect a sharp rise in the gold price. On the contrary. In the short term, low inflation and the prospect of rising interest rates in the US could even trigger a further decline in the gold price to $900 per troy ounce.