9.4

7.466 Reviews

English

EN

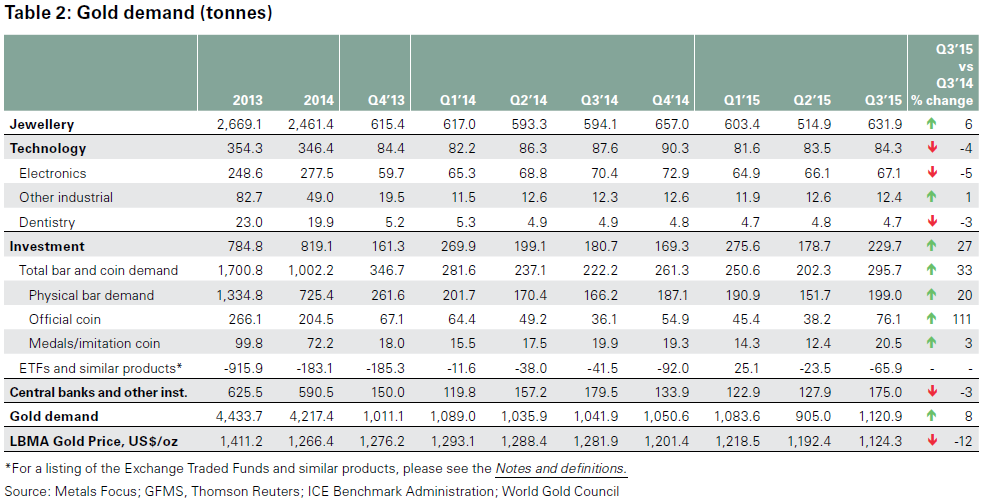

Global demand for gold rose 8% to 1,120.9 tonnes in the third quarter, the highest level in more than two years. This is evident from the latest quarterly report that the World Gold Council published today. The demand for investment gold increased sharply, while more jewellery was sold in the most important markets in Asia. Central banks again bought a lot of gold in the third quarter, while the demand for paper gold in the form of gold ETFs weakened.

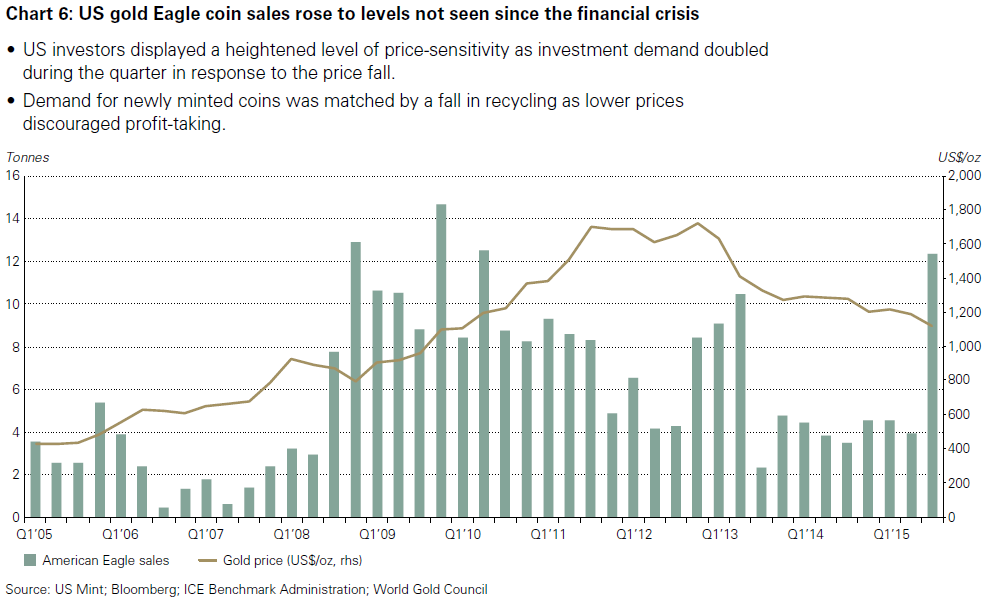

The decline in the Gold price In July, it gave a big boost to the physical gold market. In the United States, a total of 32.7 tonnes of gold bars and coins were sold, which is about three times as much as in the same quarter of last year. In the past five years, never before has so much gold been sold in one quarter as in the past quarter.

In Europe, too, coins and bars were in short supply. Total demand came in at 60.9 tonnes, making this the best third quarter for the European gold market since 2011. The total volume for the first nine months of this year is 20% higher than that of the same period last year. Interest in the precious metal was particularly high in Germany and in the less developed Eastern European countries, while the launch of a series of new gold investment coins in the United Kingdom was well received by the public.

Also in the Asian market, where people prefer to Buy gold In the form of jewellery, the demand for gold bars and coins increased. The Chinese bought 52.3 tonnes of investment gold in the third quarter, an increase of 70% compared to the same period last year. In India, demand increased by only 6% to 57 tonnes.

According to the World Gold Council, not since the outbreak of the financial crisis has there been as much interest in investment gold as in the past quarter. This was particularly evident in the United States, where the US Mint saw an explosive increase in the demand for gold Eagle coins. In the third quarter, the mint sold 397,000 troy ounces of gold coins, the largest volume in a single quarter in more than five years.

Gold coins are in high demand in the US (Source: World Gold Council)

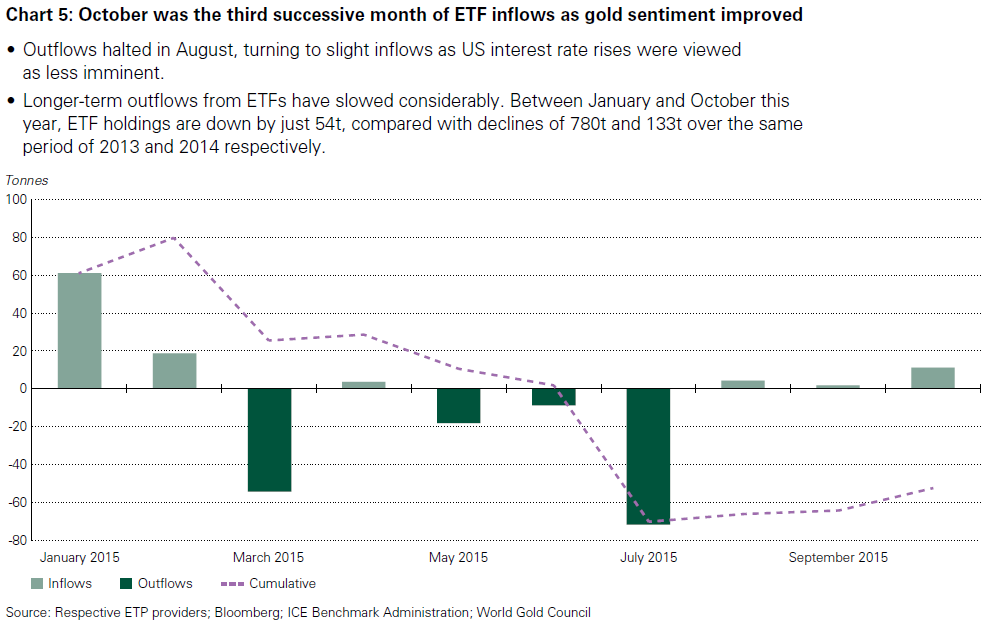

In recent years, we have seen a sustained shift from gold ownership via ETFs to private ownership of gold. Every time the price of gold falls, shares in gold ETFs such as the GLD are sold, while the demand for investment gold and jewellery increases. We also saw this phenomenon in the third quarter, because the strong increase in turnover at gold dealers was offset by a decrease of 65.9 tonnes in the gold stocks of ETFs.

Investors' preference shifts from ETF to physical gold holdings (Source: World Gold Council)

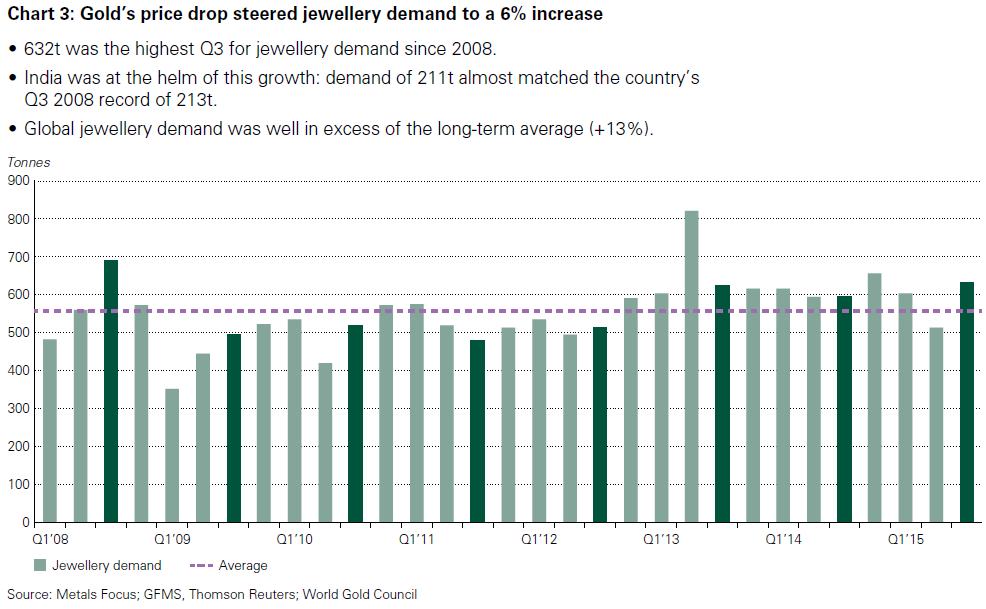

The price-conscious Indian consumer bought much more gold jewellery in the third quarter, as demand rose 15% from a year ago to 211.1 tonnes. In China, people bought 4% more gold jewellery, the demand there reached a level of 187.6 tonnes.

Globally, demand for gold jewellery rose 6% to 631.9 tonnes in the third quarter. That's 13% higher than the long-term average. If we compare the first nine months of this year with the same period last year, we see that the volume is now 3% lower at a total of 1,750.2 tonnes.

Demand for gold jewellery picks up due to drop in gold price (Source: World Gold Council)

The World Gold Council did an analysis of the search term 'gold jewellery' and saw a peak towards the end of July, when the gold price in dollars reached its lowest level in five years. These results confirm that the Chinese consumer is very price-conscious and is willing to postpone buying gold until the price is favorable.

Searches in China strongly negatively correlated with gold price (Source: World Gold Council)

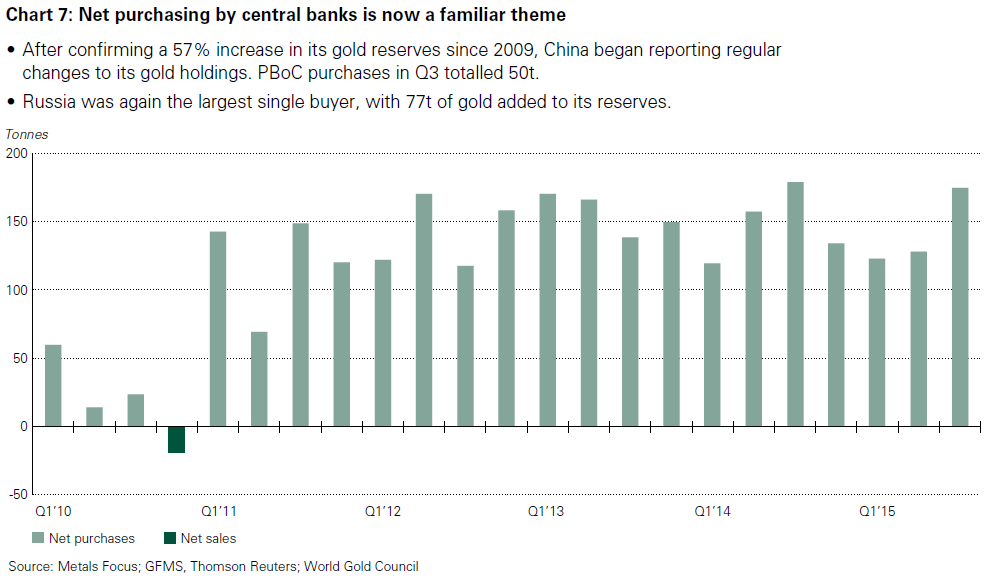

In the third quarter, central banks collectively withdrew an impressive 175 tonnes of gold from the market. That was the second-best quarter since central banks started buying gold around 2010. The main buyers of gold were the Russian central bank (77 tonnes) and the Chinese central bank (50 tonnes).

It is the first time that the purchases of the People's Bank of China have been fully included in the statistics of the World Gold Council, because it is only since June that the Chinese have been opening up about their gold stocks. This also partly explains the increase compared to previous quarters.

Other countries that bought gold were Kazakhstan (7.8 tonnes), Jordan (7.5 tonnes), Ukraine (3.1 tonnes) and the United Arab Emirates (+2.5 tonnes). The only central bank that sold a substantial amount of gold was that of Colombia. The South American country sold 6.9 tonnes of gold in the third quarter.

Central banks bought 175 tonnes of gold in third quarter (Source: World Gold Council)

Global Gold Demand Up 8% in Third Quarter (Source: World Gold Council)

Investment gold, in particular, is gaining popularity